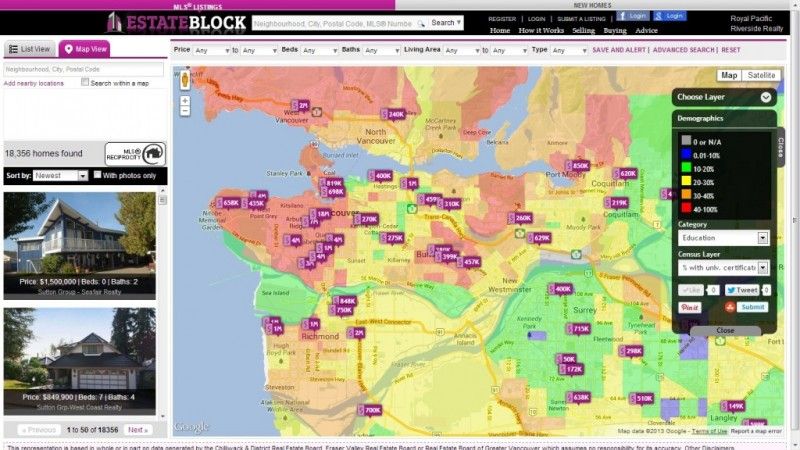

The search for the perfect home simplified: EstateBlock.com is helping Canadian homebuyers make sense of complicated data with its new house-hunting heat map technology. The new maps break down data such as demographics, crime statistics, service areas for schools and daycares, and even climate information into easy to understand color charts. EstateBlock home search tools are free.

“Searching for a new home on your own can be confusing,” says EstateBlock founder Vadim Marusin. “We’ve developed a simple technology to make the challenge of finding the right home easy.”

Using point-and-click navigation, buyers quickly filter the maps categories: Demographics, Crime, Schools, Daycares, Transit and Climate. The new real estate search engine is also equipped with advanced features that query information on local amenities such as banks, hospitals, grocery stores, parks and recreation. Buyers can also search by foreclosures, acreage and lot size, keywords, gross taxes and maintenance fees in a particular area.

Registered EstateBlock.com members can also use the Heat Map’s “save and alert” feature to receive e-mail notifications on specific queries and listings.

“The ‘right’ home is different for the individual buyer,” Marusin continues. “EstateBlock heat maps are sensitive to this reality.”

EstateBlock also offers a complimentary service to help potential buyers arrange home viewings. To search existing homes or new construction listings in Lower Mainland, B.C., or to enquire about homebuying or selling assistance, interested parties are encouraged to visit the following link: http://www.estateblock.com/.