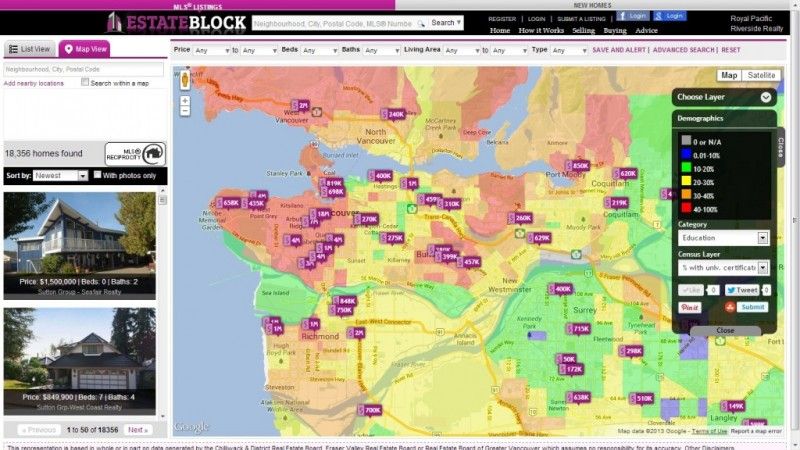

We are EstateBlock.com. One of the most innovative real estate search engines in Canada serving BC, Canada.

We spent couple days to make 9 super detailed heat maps of Lower Mainland Real Estate Prices. We broke it down to neighbourhoods and type of property so everybody can see what happened with their home prices. Enjoy!

>

Top 10 Most Expensive Neighbourhoods in Lower Mainland for Single Family Homes

1. $6,461,800 – Whitby Estates, West Vancouver

2. $5,741,100 – Shaughnessy, Vancouver West

3. $5,663,200 – University VW, Vancouver West

4. $5,176,100 – Canterbury WV, West Vancouver

5. $4,516,600 – Westhill, West Vancouver

6. $4,204,700 – Chartwell, West Vancouver

7. $4,094,900 – South Granville, Vancouver West

8. $4,000,300 – Quilchena, Vancouver West

9. $3,974,600 – Altamont, West Vancouver

10. $3,792,700 – Arbutus, Vancouver West

Top 10 Least Expensive Neighbourhoods in Lower Mainland for Single Family Homes

1. $476,500 – Dewdney Deroche, Mission

2. $529,900 – Pender Harbour Egmont, Sunshine Coast

3. $539,900 – Bridgeview, North Surrey

4. $565,800 – Sechelt District, Sunshine Coast

5. $589,300 – Halfmn Bay Secret Cv Redroofs, Sunshine Coast

6. $592,600 – Durieu, Mission

7. $678,700 – Gibsons & Area, Sunshine Coast

8. $680,900 – Mission BC, Mission

9. $697,100 – Hatzic, Mission

10. $720,800 – Roberts Creek, Sunshine Coast

Top 10 Neighbourhoods Where Single-Family Homes Prices Have Risen the Most Last Month.

1. 6.28% – Port Moody Centre, Port Moody

2. 5.70% – Parkcrest, Burnaby North

3. 5.27% – Chineside, Coquitlam

4. 5.19% – Northyards, Squamish

5. 5.18% – Hazelmere, White Rock

6. 5.05% – Brentwood Park, Burnaby North

7. 4.99% – Fort Langley, Langley

8. 4.93% – Bradner, Abbotsford

9. 4.84% – Central BN, Burnaby North

10. 4.82% – Sullivan Heights, Burnaby North

Top 10 Neighbourhoods Where Single-Family Homes Prices Have Risen the Least or Descended Last Month.

1. -5.30% – University VW, Vancouver West

2. -5.28% – Canterbury WV, West Vancouver

3. -4.72% – McLennan North, Richmond

4. -4.37% – Point Grey, Vancouver West

5. -4.36% – Elgin Chantrell, White Rock

6. -4.33% – Garden City, Richmond

7. -4.26% – Woodwards, Richmond

8. -3.97% – Altamont, West Vancouver

9. -3.96% – Mount Pleasant VW, Vancouver West

10. -3.72% – West Cambie, Richmond

Top 10 Neighbourhoods Where Single-Family Homes Prices Have Risen the Most Last Year.

1. 23.58% – Langley City, Langley

2. 22.40% – Northeast, Maple Ridge

3. 22.03% – Central Abbotsford, Abbotsford

4. 21.30% – Poplar, Abbotsford

5. 21.27% – Whalley, North Surrey

6. 21.19% – Sumas Mountain, Abbotsford

7. 20.80% – Pender Harbour Egmont, Sunshine Coast

8. 20.80% – Sumas Prairie, Abbotsford

9. 20.50% – Silver Valley, Maple Ridge

10. 20.40% – Sechelt District, Sunshine Coast

Top 10 Neighbourhoods Where Single-Family Homes Prices Have Risen the Least or Descended Last Year.

1. -12.40% – South Granville, Vancouver West

2. -8.35% – Elgin Chantrell, White Rock

3. -7.20% – Cypress, West Vancouver

4. -7.00% – MacKenzie Heights, Vancouver West

5. -7.00% – Kitsilano, Vancouver West

6. -5.80% – Kerrisdale, Vancouver West

7. -5.50% – University VW, Vancouver West

8. -5.00% – Terra Nova, Richmond

9. -4.50% – West Bay, West Vancouver

10. -4.20% – Sunnyside Park Surrey, White Rock

Top 10 Most Expensive Neighbourhoods in Lower Mainland for Condos

1. $3,214,500 – Cypress Park Estates, West Vancouver

2. $1,514,800 – Panorama Village, West Vancouver

3. $1,512,400 – Dundarave, West Vancouver

4. $1,332,600 – Park Royal, West Vancouver

5. $1,274,300 – Capilano NV, North Vancouver

6. $1,147,700 – Quilchena, Vancouver West

7. $1,145,300 – Edgemont, North Vancouver

8. $1,122,500 – Oakridge VW, Vancouver West

9. $1,063,300 – Coal Harbour, Vancouver West

10. $1,021,600 – South Granville, Vancouver West

Top 10 Least Expensive Neighbourhoods in Lower Mainland for Condos

1. $263,500 – Granville, Richmond

2. $276,600 – Central Coquitlam, Coquitlam

3. $285,900 – Otter District, Langley

4. $286,900 – Annieville, N. Delta

5. $295,400 – West Central, Maple Ridge

6. $302,400 – Cedar Hills, North Surrey

7. $324,000 – South Arm, Richmond

8. $324,100 – College Park PM, Port Moody

9. $330,400 – West End NW, New Westminster

10. $342,100 – Abbotsford West, Abbotsford

Top 10 Neighbourhoods Where Condos Prices Have Risen the Most Last Month.

1. 12.38% – Garibaldi Estates, Squamish

2. 12.08% – Valleycliffe, Squamish

3. 9.83% – Downtown SQ, Squamish

4. 7.97% – Brighouse, Richmond

5. 7.08% – Otter District, Langley

6. 6.48% – Boyd park, Richmond

7. 6.44% – Seafair, Richmond

8. 6.23% – Aldergrove Langley, Langley

9. 6.06% – Abbotsford East, Abbotsford

10. 6.03% – Maillardville, Coquitlam

Top 10 Neighbourhoods Where Condos Prices Have Risen the Least or Descended Last Month.

1. -3.96% – Shaughnessy, Vancouver West

2. -3.64% – Southlands, Vancouver West

3. -3.32% – Killarney VE, Vancouver East

4. -2.80% – Dunbar, Vancouver West

5. -2.67% – Kerrisdale, Vancouver West

6. -2.61% – Quilchena, Vancouver West

7. -2.36% – Fraser VE, Vancouver East

8. -2.32% – College Park PM, Port Moody

9. -2.29% – Highgate, Burnaby South

10. -2.26% – Metrotown, Burnaby South

Top 10 Neighbourhoods Where Condos Prices Have Risen the Most Last Year.

1. 55.70% – Central Abbotsford, Abbotsford

2. 55.53% – Annieville, N. Delta

3. 54.31% – Bear Creek Green Timbers, Surrey

4. 53.66% – Cedar Hills, North Surrey

5. 53.10% – Northwest Maple Ridge, Maple Ridge

6. 52.59% – Langley City, Langley

7. 51.90% – West Central, Maple Ridge

8. 51.20% – East Central, Maple Ridge

9. 50.85% – West Newton, Surrey

10. 50.38% – East Newton, Surrey

Top 10 Neighbourhoods Where Condos Prices Have Risen the Least or Descended Last Year.

1. 10.80% – False Creek, Vancouver West

2. 12.90% – Downtown VW, Vancouver West

3. 13.00% – Mount Pleasant VE, Vancouver East

4. 13.40% – Ladner Elementary, Ladner

5. 13.50% – Steveston South, Richmond

6. 14.10% – Oakridge VW, Vancouver West

7. 14.90% – Coal Harbour, Vancouver West

8. 15.00% – South Cambie, Vancouver West

9. 15.80% – South Granville, Vancouver West

10. 16.10% – Quilchena, Vancouver West

Top 10 Most Expensive Neighbourhoods in Lower Mainland for Townhomes

1. $2,469,000 – Shaughnessy, Vancouver West

2. $1,918,100 – South Cambie, Vancouver West

3. $1,856,500 – Coal Harbour, Vancouver West

4. $1,788,600 – University VW, Vancouver West

5. $1,783,200 – Yaletown, Vancouver West

6. $1,648,900 – Oakridge VW, Vancouver West

7. $1,590,500 – Kerrisdale, Vancouver West

8. $1,586,100 – Quilchena, Vancouver West

9. $1,274,400 – Mount Pleasant VW, Vancouver West

10. $1,246,100 – Cambie, Vancouver West

Top 10 Least Expensive Neighbourhoods in Lower Mainland for Townhomes

1. $362,900 – Central Abbotsford, Abbotsford

2. $384,100 – Abbotsford West, Abbotsford

3. $385,100 – Abbotsford East, Abbotsford

4. $420,000 – Aldergrove Langley, Langley

5. $449,400 – Mission BC, Mission

6. $467,600 – Boyd park, Richmond

7. $470,900 – Annieville, N. Delta

8. $476,600 – Central Coquitlam, Coquitlam

9. $478,000 – Maillardville, Coquitlam

10. $480,300 – Langley City, Langley

Top 10 Neighbourhoods Where Townhomes Prices Have Risen the Most Last Month.

1. 13.36% – Northyards, Squamish

2. 12.77% – Dentville, Squamish

3. 9.12% – Garibaldi Highlands, Squamish

4. 8.58% – Brackendale, Squamish

5. 7.33% – Garibaldi Estates, Squamish

6. 7.21% – Shaughnessy, Vancouver West

7. 6.92% – Langley City, Langley

8. 6.45% – Downtown SQ, Squamish

9. 6.37% – Central Abbotsford, Abbotsford

10. 6.03% – King George Corridor, White Rock

Top 10 Neighbourhoods Where Townhomes Prices Have Risen the Least or Descended Last Month.

1. -4.02% – Coal Harbour, Vancouver West

2. -3.55% – Burnaby Hospital, Burnaby South

3. -2.20% – College Park PM, Port Moody

4. -1.68% – Abbotsford West, Abbotsford

5. -1.52% – Brighouse South, Richmond

6. -1.41% – Coquitlam East, Coquitlam

7. -1.18% – Maillardville, Coquitlam

8. -0.94% – Central Coquitlam, Coquitlam

9. -0.85% – Yaletown, Vancouver West

10. -0.74% – Guildford, North Surrey

Top 10 Neighbourhoods Where Townhomes Prices Have Risen the Most Last Year.

1. 40.31% – Central Abbotsford, Abbotsford

2. 32.06% – Guildford, North Surrey

3. 31.20% – Cottonwood MR, Maple Ridge

4. 30.60% – Collingwood VE, Vancouver East

5. 30.13% – Poplar, Abbotsford

6. 29.98% – East Newton, Surrey

7. 29.93% – Aldergrove Langley, Langley

8. 29.90% – Southwest Maple Ridge, Maple Ridge

9. 29.80% – Victoria VE, Vancouver East

10. 29.70% – Brackendale, Squamish

Top 10 Neighbourhoods Where Townhomes Prices Have Risen the Least or Descended Last Year.

1. 4.90% – Kitsilano, Vancouver West

2. 5.10% – Oakridge VW, Vancouver West

3. 5.70% – University VW, Vancouver West

4. 5.80% – Kerrisdale, Vancouver West

5. 6.30% – Cambie, Vancouver West

6. 6.40% – Point Grey, Vancouver West

7. 6.60% – False Creek, Vancouver West

8. 6.90% – Steveston Village, Richmond

9. 7.10% – Coal Harbour, Vancouver West

10. 7.90% – Boyd park, Richmond

Greater Vancouver April 2018 Market Update

April saw more home sellers than buyers in the Metro Vancouver* housing market.

Residential property sales in the region totalled 2,579 in April 2018, a 27.4 percent decrease from the 3,553 sales recorded in April 2017, and a 2.5 percent increase compared to March 2018 when 2,517 homes sold, according to the Real Estate Board of Greater Vancouver. Last month’s sales were 22.5 percent below the 10-year April sales average.

Changing market conditions are evident, this is due in part to the new mortgage requirements implemented by the federal government which have diminished home buyer’s purchasing power.

A total of 5,820 detached, attached and apartment properties were newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in April 2018, representing an 18.6 percent increase compared to the 4,907 homes listed in April 2017 and a 30.8 percent increase compared to March 2018 when 4,450 homes were listed.

Currently, the number of properties listed for sale on the MLS® system in Metro Vancouver is 9,822, a 25.7 percent increase compared to April 2017 (7,813) and a 17.2 percent increase compared to March 2018 (8,380).

For April 2018, the sales-to-active listings ratio is 26.3 percent for all property types. By property type, the ratio is 14.1 percent for detached homes, 36.1 percent for townhomes, and 46.7 percent for condominiums.

Generally, downward pressure on home prices occurs when the ratio dips below the 12 percent mark for a sustained period, according to analysts, while home prices often experience upward pressure when it surpasses 20 percent over several months.

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,092,000. This represents a 14.3 percent increase over April 2017 and a 0.7 percent increase compared to March 2018.

There were 807 sales of detached properties in April 2018, which was a 3.4 percent decrease from the 1,211 detached sales recorded in April 2017. The benchmark price for detached properties is $1,605,800. This represents a 5.1 percent increase from April 2017 and a 0.2 percent decrease compared to March 2018.

Sales of apartment properties decreased 24 percent from last year, reaching 1,308 in April 2018. The benchmark price of an apartment property is $701,000. This represents a 23.7 percent increase from April 2017 and a 1.1 percent increase compared to March 2018.

Sales of attached properties in April 2018 totalled 464, a 25.2 percent decrease compared to the 620 sales in April 2017. The benchmark price of an attached unit is $854,200. This represents a 17.7 percent increase from April 2017 and a 2.3 percent increase compared to March 2018.

In the Fraser Valley, buying activity remained modest throughout the month of April despite a bump in inventory across all three major residential types.

The Fraser Valley Real Estate Board saw 1,708 sales across all property types in April 2018, a decrease of 23.4 percent compared to the 2,230 sales in April of last year, and a 2.6 percent increase compared to the 1,664 sales in March 2018.

Of those sales, 413 were townhomes and 498 were apartments, together making up 53 percent of all transactions in April.

At the end of April 5,667 listings remained active, an increase of 18.2 percent month over month, and 15.3 percent when compared to April 2017.

3,429 new listings went up in April, a 19.7 percent increase from March 2018’s 2,865 new listings, and a 16.2 percent increase compared to April 2017.

The average number of days to sell an apartment in April was 14, and 16 for townhomes in the Fraser Valley region.

It took single family detached homes an average of 26 days on the market before selling.

HPI® Benchmark Price Activity

• Single Family Detached: At $1,009,200, the Benchmark price for a single family detached home in the Valley increased 0.8 percent compared to March 2018, and 13.5 percent compared to April 2017.

• Townhomes: At $549,900, the Benchmark price for a townhome in the Fraser Valley increased 1.5 percent compared to March 2018, and 23 percent compared to April 2017.

• Apartments: At $447,500, the Benchmark price for apartments/condos in the Fraser Valley increased 1.6 percent compared to March 2018, and 45.8 percent compared to April 2017.

Feel free to share this map and subscribe for more cool heat maps!

For more Lower Mainland Heat Maps – click here