March 2023 Lower Mainland Real Estate Prices Map

Well butter my biscuits, have I got a treat for all you real estate enthusiasts out there! We are EstateBlock.com by Renanza Realty Inc. created a map of Lower Mainland, BC that’s so hot, it’s practically on fire!

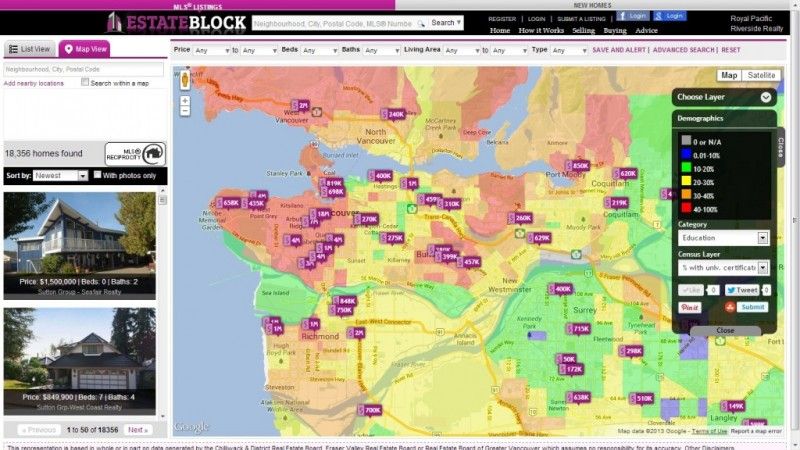

This map shows average real estate prices in different neighborhoods of Lower Mainland, color-coded like a heat map. You can easily see which neighborhoods are the most expensive (red hot!) and which ones are a bit more affordable (cool blue). And if you’re searching for a specific property type, no problem! You can use the search function to filter by property type and find exactly what you’re looking for.

But wait, there’s more! This map isn’t just informative, it’s also fun. It’s like playing a game of real estate roulette, trying to find the best deals and hottest neighborhoods. So, grab a cup of coffee, sit back, and get ready to explore the wild world of Lower Mainland real estate with this amazing map.

March 2023 Lower Mainland Real Estate Prices Map by Neighbourhood

Top 10 Most Expensive Neighbourhoods in Lower Mainland for Single Family Homes

- 1. $5.29M – Chartwell, West Vancouver

- 2. $4.97M – Shaughnessy, Vancouver West

- 3. $4.96M – Altamont, West Vancouver

- 4. $4.94M – Westmount WV, West Vancouver

- 5. $4.09M – Quilchena, Vancouver West

- 6. $4.05M – South Cambie, Vancouver West

- 7. $3.94M – South Granville, Vancouver West

- 8. $3.63M – Arbutus, Vancouver West

- 9. $3.52M – Kerrisdale, Vancouver West

- 10. $3.49M – Oakridge VW, Vancouver West

10 Least Expensive Neighbourhoods in Lower Mainland for Single Family Homes

- 1. $792K – Pender Harbour Egmont, Sunshine Coast, BC

- 2. $830K – Sechelt District, Sunshine Coast, BC

- 3. $877K – Gibsons & Area, Sunshine Coast, BC

- 4. $897K – Mission BC, Mission, BC

- 5. $914K – Bridgeview, North Surrey, BC

- 6. $920K – Dewdney Deroche, Mission, BC

- 7. $920K – Halfmoon Bay Secret Cv Redroofs, Sunshine Coast, BC

- 8. $944K – Central Abbotsford, Abbotsford, BC

- 9. $963K – Roberts Creek, Sunshine Coast, BC

- 10. $978K – Poplar, Abbotsford, BC

Top 10 Hottest Neighboourhoods in Lower Mainland Now, by Price appreciation in 1 Month, Single Family Homes

- 1. +9.8% – S.W. Marine, Vancouver West, BC

- 2. +9.7% – MacKenzie Heights, Vancouver West, BC

- 3. +9.6% – Southlands, Vancouver West, BC

- 4. +9.2% – Simon Fraser Univer., Burnaby North, BC

- 5. +8.9% – Sea Island, Richmond, BC

- 6. +8.3% – Stave Falls, Mission, BC

- 7. +8.3% – Chineside, Coquitlam, BC

- 8. +8.3% – Kerrisdale, Vancouver West, BC

- 9. +8.2% – Terra Nova, Richmond, BC

- 10. +8.1% – Hatzic, Mission, BC

Top 10 Neighboourhoods that are losing Value in Lower Mainland Now, by Price depreciation in 1 Month, Single Family Homes

- 1. -6.8% – Mount Pleasant VW, Vancouver West, BC

- 2. -5.7% – Cypress, West Vancouver, BC

- 3. -4.4% – Bear Creek Green Timbers, Surrey, BC

- 4. -4.3% – West Bay, West Vancouver, BC

- 5. -3.9% – Sumas Prairie, Abbotsford, BC

- 6. -3.7% – Serpentine, Cloverdale, BC

- 7. -3.4% – County Line Glen Valley, Langley, BC

- 8. -3.4% – Bayridge, West Vancouver, BC

- 9. -3.3% – Lions Bay, West Vancouver, BC

- 10. -3.2% – Mount Pleasant VE, Vancouver East, BC

Top 10 Neighbourhoods that appreciated in Value the Most in the last 3 years, Single Family Homes

- 1. 149.74% – Sea Island, Richmond, BC

- 2. 108.17% – Maillardville, Coquitlam, BC

- 3. 86.52% – Anmore, Port Moody, BC

- 4. 86.07% – Seafair, Richmond, BC

- 5. 76.11% – Forest Hills NV, North Vancouver, BC

- 6. 70.88% – Harbour Chines, Coquitlam, BC

- 7. 68.91% – Deer Lake, Burnaby South, BC

- 8. 66.92% – Tantalus, Squamish, BC

- 9. 66.09% – Westridge BN, Burnaby North, BC

- 10. 65.33% – Central Coquitlam, Coquitlam, BC

Top 10 Neighbourhoods that didn’t appreciate or Lost in Value in the last 3 years, Single Family Homes

- 1. -44.64% – University VW, Vancouver West, BC

- 2. -35.86% – Howe Sound, West Vancouver, BC

- 3. -10.18% – University Highlands, Squamish, BC

- 4. -8.74% – Mount Pleasant VW, Vancouver West, BC

- 5. -7.2% – Point Grey, Vancouver West, BC

- 6. -5.62% – Brennan Center, Squamish, BC

- 7. -3.24% – Horseshoe Bay WV, West Vancouver, BC

- 8. +0.69% – Westhill, West Vancouver, BC

- 9. +5.06% – English Bluff, Tsawwassen, BC

- 10. +5.58% – Strathcona, Vancouver East, BC

* Map and Reports are made using MLS® HPI Benchmark Price Stats Reports.

We are EstateBlock.com by Renanza Realty Inc. One of the most innovative real estate search engines in Canada powered by the one of the Best Real Estate agents in town. To get a Professional Market Evaluation done for you property, please click here

9 Heat maps that will explain greater vancouver real estate market

9 Heat maps that will explain Greater Vancouver real estate market

How to find out a sold price for Vancouver homes without calling a REALTOR®

How to find out a sold price for Vancouver homes without calling a REALTOR®

Vancouver Land Prices Heat Map

Sorry, this map is no longer accurate. Please stay tuned for the more cool maps in our blog.

Immigrants of Metro Vancouver by majority in the neighbourhood

Please hover the neighbourhoods for more information. Have any questions? Feel free to ask us in the comments below.

Feel free to share this map and subscribe for more cool heat maps!

EstateBlock.com Makes Home Searching Easy with New Heat Map Technology

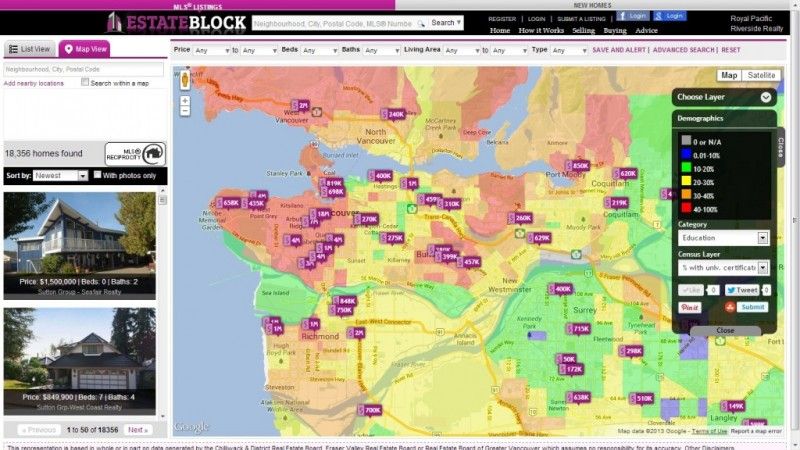

The search for the perfect home simplified: EstateBlock.com is helping Canadian homebuyers make sense of complicated data with its new house-hunting heat map technology. The new maps break down data such as demographics, crime statistics, service areas for schools and daycares, and even climate information into easy to understand color charts. EstateBlock home search tools are free.

“Searching for a new home on your own can be confusing,” says EstateBlock founder Vadim Marusin. “We’ve developed a simple technology to make the challenge of finding the right home easy.”

Using point-and-click navigation, buyers quickly filter the maps categories: Demographics, Crime, Schools, Daycares, Transit and Climate. The new real estate search engine is also equipped with advanced features that query information on local amenities such as banks, hospitals, grocery stores, parks and recreation. Buyers can also search by foreclosures, acreage and lot size, keywords, gross taxes and maintenance fees in a particular area.

Registered EstateBlock.com members can also use the Heat Map’s “save and alert” feature to receive e-mail notifications on specific queries and listings.

“The ‘right’ home is different for the individual buyer,” Marusin continues. “EstateBlock heat maps are sensitive to this reality.”

EstateBlock also offers a complimentary service to help potential buyers arrange home viewings. To search existing homes or new construction listings in Lower Mainland, B.C., or to enquire about homebuying or selling assistance, interested parties are encouraged to visit the following link: http://www.estateblock.com/.

EstateBlock.com Makes Home Searching Easy with New Heat Map Technology

The search for the perfect home simplified: EstateBlock.com is helping Canadian homebuyers make sense of complicated data with its new house-hunting heat map technology. The new maps break down data such as demographics, crime statistics, service areas for schools and daycares, and even climate information into easy to understand color charts. EstateBlock home search tools are free.

“Searching for a new home on your own can be confusing,” says EstateBlock founder Vadim Marusin. “We’ve developed a simple technology to make the challenge of finding the right home easy.”

Using point-and-click navigation, buyers quickly filter the maps categories: Demographics, Crime, Schools, Daycares, Transit and Climate. The new real estate search engine is also equipped with advanced features that query information on local amenities such as banks, hospitals, grocery stores, parks and recreation. Buyers can also search by foreclosures, acreage and lot size, keywords, gross taxes and maintenance fees in a particular area.

Registered EstateBlock.com members can also use the Heat Map’s “save and alert” feature to receive e-mail notifications on specific queries and listings.

“The ‘right’ home is different for the individual buyer,” Marusin continues. “EstateBlock heat maps are sensitive to this reality.”

EstateBlock also offers a complimentary service to help potential buyers arrange home viewings. To search existing homes or new construction listings in Lower Mainland, B.C., or to enquire about homebuying or selling assistance, interested parties are encouraged to visit the following link: http://www.estateblock.com/.

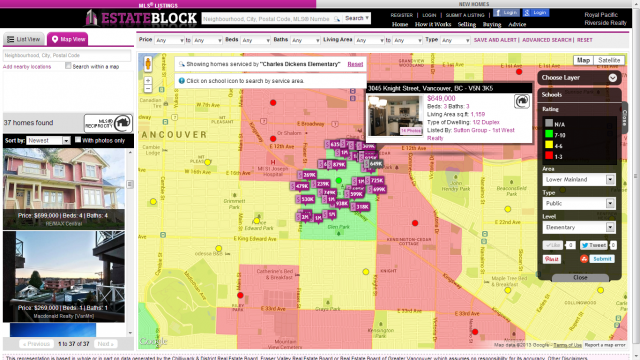

Vancouver startup EstateBlock.com has created a search engine that helps parents buy homes near top rated schools.

It’s a nightmare scenario for any home buying parent. It’s almost school time for the kids, but the family is still looking for a new place to live. After weeks or sometimes months of endless searching, they think they’ve found the perfect home. They did the home tours, travelled around with an agent from one neighbourhood to another, and finally seem to have found what they want.

Not too big or too small, the new home has every feature on their list, and the price is within their budget. Finally, they close on the house and the whole family moves in.

Only later, after the kids are in school, do the problems arise. What seemed like a nice neighbourhood, turns out to have a not-so-nice school district. No parent wants this to happen, but how can they be sure their new home is right in the first place?

The EstateBlock.com website allows users to enter a search for new homes to buy, but unlike many other real estate websites on the internet today, the site gives a lot more information in its results.

“Parents want more information when buying a home for their family, not less,” said Vadim Marusin, one of the startup’s founders. “This is where the real power of our search engine comes in.”

“Anyone can search and in a few moments know exactly all the information they could want about a specific neighbourhood. The results can be filtered to give exactly the details that a person needs.”

“For example, the search engine can show how good a school district is near a home, or how much crime is in the area” among dozens of other options, he said.

For parents, the benefits are obvious. Instead of days of research about school districts and looking for ratings and boundaries, they can instead have that information in moments.

“Imagine easily finding a home in an excellent public school district, versus moving to another district and now having to pay for a private school,” he said. “That’s our goal, to help every family get exactly the home they want.”

Sick of Vancouver RE prices? Best Houses in Cloverdale,BC under $500K (Handpicked by EstateBlock.com)

What you can buy in Cloverdale, BC under $5oo,000 if you are looking for a house? We scanned all database and handpicked 5 best properties specifically for you. Enjoy!

1. 6393 190th Street, Surrey, BC, MLS# F1316457

Cozy rancher featuring 4 spacious bedrooms, 2 full baths, A/C and more.

This rancher on a massive lot features a great floor plan; off the entrance walk into the combo dining-living area with great bay windows. Next, off the bright kitchen you have a family room with sliding door to your hot tub and manicured backyard. It features a new deck and plenty of space for the kids or to entertain.

Back inside you will find 4 bedrooms, and 2 full baths, with the master featuring an ensuite and walk-in closet. The double garage offers plenty of space for your vehicles or toys.

The beautiful front yard boasts plenty of parking and a BONUS area to park your RV/Trailer on the side of the home. Call today to schedule your viewing!

Listed by: Lighthouse Realty Ltd.

2. 6733 185a Street, Surrey, BC, MLS# F1318792

The well maintenance Fraserville model. Renovated 2013. 2 storey PLUS finished basement. 4 bedrooms, 3 1/2 baths, 1 natural gas fireplaces. 1 carport from laneway and lots of visitor parking.

Quiet and quaint neighborhood. Walking to Hillcrest Elementary School and Pacific Academy nearby, perfect for your kids.

Do not miss your really AFFORDABLE price.

Listed By: Royal Pacific Realty Corp.

3. 6513 184a Street, Surrey, BC, MLS# F1310256

Park lane built 4 bedroom 4 bathroom 2 storey home with fully finished basement.

Corner lot with rear lane access, close to shopping, recreation, schools and transport. Great plan for the family, and could easily be suited for extended family down with separate entrance.

Covered front porch. Loads of storage space. Fabulous value at this price. Too many features to list, call for more information and appointments to view.

Listed By: Prudential Power Play Realty

4. 18918 60 Ave, Surrey, BC, MLS# F1316995

QUICK POSSESSON POSSIBLE! Very well kept and updated home on large southern exposed lot with RV parking.

Upgrades include: newer roof, flooring, stainless steel appliances, newer paint, the list goes on. Great floor plan with kitchen and family room looking over sunny fully fenced backyard. Call today!

Listed By: Re/Max Treeland Realty

5. 6179 192nd Street, Surrey, BC, MLS# F1312566

Bright basement entry in central location with view of Mt. Baker. Private hedge on 192.

Some updates include neutral paint, carpet, doors. Lots of notice preferred. Do not enter yard without appt. Dog on Property.

Listed By: Homelife Benchmark Rlty.