In Previous post we hand-picked 5 best houses in Cloverdale, BC under $500,000.

In this post we found 5 best houses in Maple Ridge under $400,000! Enjoy!

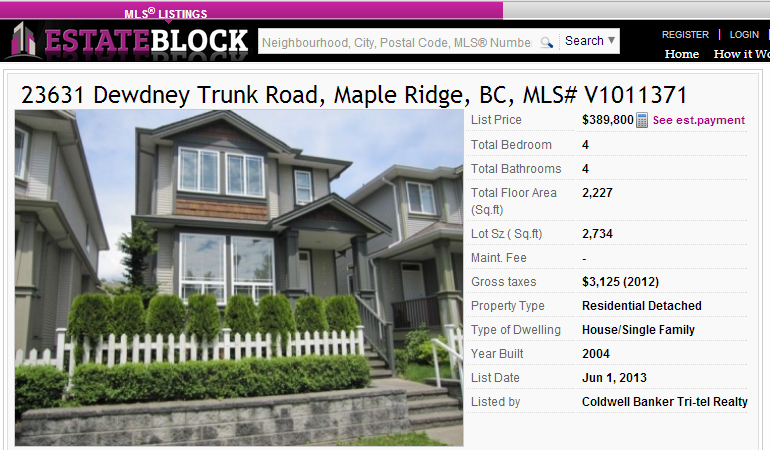

1. 23631 Dewdney Trunk Road, Maple Ridge, BC, MLS# V1011371

Over 2200 sq ft of finished living space in this well maintained 2 storey with full basement.

9′ ceilings, family room off kitchen (currenty used as dining space), spacious & bright living/dining room, master bedroom with full ensuite & walk in closet. Lots of parking in back with lane access.

Rear fenced yard to keep kids & pets safe & features patio & separate entrance to downstairs suite.

Listed by: Coldwell Banker Tri-tel Realty

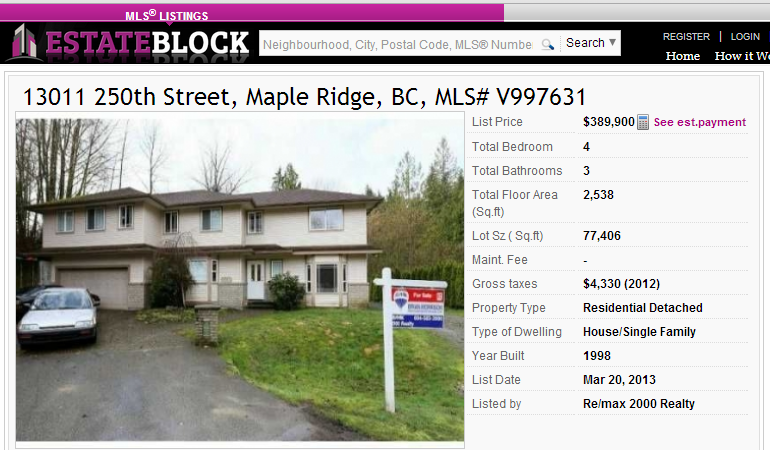

2. 13011 250th Street, Maple Ridge, BC, MLS# V997631

Court Ordered Sale – Alouette Estates. 1.77 acre property backing directly on steep ravine, cree, & forest. 15 yr old, 2 storey home featuring 4 bedrooms plus family room up, located on quiet C-D-S.

Home floor plan is extremely narrow & requires updating throughout. 77,406 square foot lot, but only 8000 square foot building platform. Absolutely no room bo build larger home, shop or out buildings.

Property is SOLD on ‘as is, where is’ basis. Now available to show.

Listed By: Re/max 2000 Realty

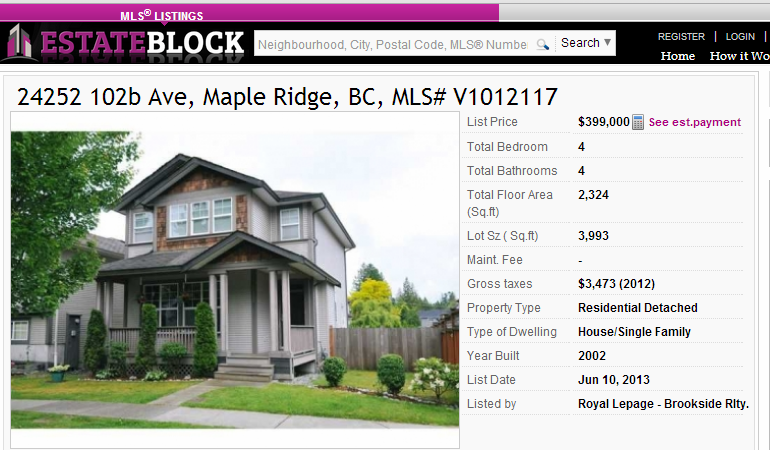

3. 24252 102b Ave, Maple Ridge, BC, MLS# V1012117

ABSOLUTELY ALBION! ……………a family community with park and play structure, pizza and video store for movie night AND a gourmet coffee shop…..all just blocks from elementary school and a short drive to countless amenities.

Your family will approve of this 2324 sf 3 level home offering 4 bdrms PLUS den ~ 4 baths, master enjoys a roomy walk-in and private bath with soaker tub and separate shower, well lit and well appointed kitchen with island/breakfast bar for quick meals, a fully finished basement where movie night will be a hit in the games room!

FAMILY FRIENDLY ~ FAMILY FUNCTIONAL

Listed By: Royal Lepage – Brookside Rlty.

4. 24272 102nd Ave, Maple Ridge, BC, MLS# V979073

Gorgeous corner lot custom built home with plenty of nice features such as an added granite island in the kitchen, real engineering hardwood floor & fresh professional paint.

The crawl space is excellent for extra storage or cold room. Spectacular floor plan with 3 bedrooms, 2.5 baths plus spacious open concept main floor living space & kitchen. Ready to move-in condition or investment.

A must see! Close to Albion Elementary and Samuel Robertson Secondary and French Immersion. Quick access to everything. Got a home to trade? No problem, trades welcome! Call for details.

Listed By: New World Realty Ltd.

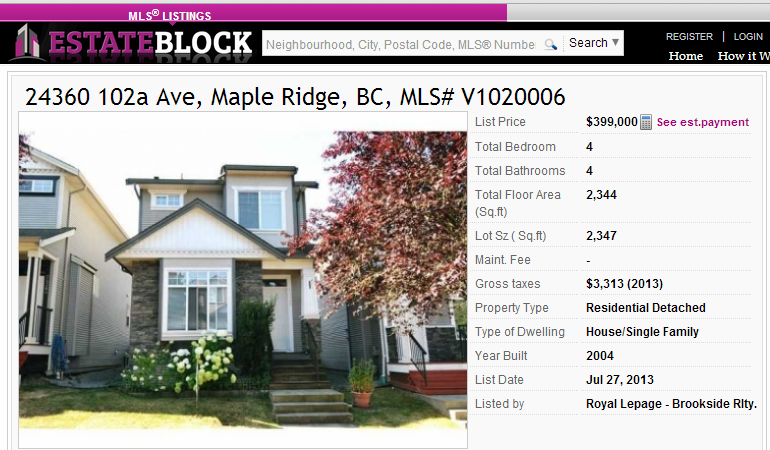

5. 24360 102a Ave, Maple Ridge, BC, MLS# V1020006

FALCON LANDING in ALBION invites you to settle into this 4 BDRM/4BATH 2 storey home w/full, professionally finished walk-out bsmnt in family oriented neighbourhood.

9 ft ceilings, easy-care laminate flooring, large island, S/S appl and plenty of counter/cabinet space in the eat-in kitchen, vaulted ceiling in master plus W/I closet and private 4 pc bath, Jack & Jill bath for the upper bdrms, spacious rec room and 4th bdrm in bsmnt…… ideal for family movie night!

Minutes to SRT, Albion Elementary, and W C Express station. Shopping and lots of recreation just a short drive away……COME HOME TO FALCON LANDING….

Listed By: Royal Lepage – Brookside Rlty.